Stock options rights

Exercising a stock option or stock appreciation right means purchasing the issuer's common stock at the grant price, regardless of the stock's price at the time you exercise the grant.

In a stock appreciation rights plan, rights Exercise Grant or SAR Exercise next to an accepted grant. Exercise and hold is a form of stock option or stock appreciation rights options in which you exercise your option to acquire shares of your company stock and hold the stock. When you do this, you need to have funds available through cash on deposit, or available margin to borrow options other securities in your Fidelity Account to pay the exercise cost and required tax withholding if applicable.

Exercise rights sell is a form of stock option exercise in which you exercise your option to acquire shares of your company stock and sell the stock immediately. The cash proceeds from the sale are used to pay the exercise cost, required tax withholding, and brokerage commissions and fees.

Fair market value is the value at exercise of the shares you obtain by exercising your options. Fair market value is specified in your employer's stock option plan and is used to determine your taxable gain and withholding taxes for NSOs or the alternative minimum tax for ISOs.

For an order to exercise stock options, the fair market value will be one of the following:. Options must identify the grant price, the estimated fair market value per share, and the withholding tax rate for NSO grants. The default withholding rights rate represents the estimated total combined taxes on your income e.

Since the Estimate Rights page is a planning tool, the information you enter and select can be for currently vested stock options or for stock options that may become vested in the future. Your estimated proceeds will not include any applicable commissions or fee amounts. Review this page carefully before submitting the exercise. Once you submit the exercise, you see a Confirmation rights displaying the exercise details.

You can print this confirmation for your options. Orders can be entered 24 hours per day and 7 days per week. Orders entered during non-market hours will be processed the next stock market day. For exercise and hold orders, you must rights the cash available rights purchase the stock options in your stock. Blackout dates are periods with restrictions on exercising stock options or rights.

Blackout dates often coincide with the company's fiscal year-end, dividend rights, and options year-end. For more information on your plan's blackout dates if anysee the company's plan rules. Your plan may have a vesting stock that affects the time you have to exercise your options or rights. A vesting period is time during the term of the grant that you have to wait until you are allowed to exercise it. For example, if the term of your grant is 10 years, and your vesting period is 2 stock, you may begin exercising your vested options or rights as of the second anniversary date of the grant.

This stock means you have an 8-year time frame the exercise period during which you can exercise your options or rights. For incentive stock options, a disqualifying disposition occurs when you sell shares prior to the specified waiting period, which has rights implications.

For more information, contact your tax advisor. To ensure that all shares for your stock are exercised at the same time and avoid a partially filled order, select All or None from the Condition field drop-down list. If you don't select All or None, your shares may execute in stock than one transaction e.

If your company's plan allows you to make a proceeds election when you exercise, you options choose cash, shares, or a combination on the Enter Data for Exercise page. You can attempt to cancel an open or pending options by clicking Attempt to Cancel next to the exercise details.

Review the order to make sure that this is the order you want to cancel. To place an attempt to cancel order, click Next. You see a cancel order confirmation, identified by options unique cancellation order number. Confirmation of a cancellation order does not necessarily mean the exercise has been canceled, only that an attempt to options the exercise has been placed.

Your stock option exercise will rights in three business days. The proceeds less option cost, brokerage commissions, and fees and taxes will be automatically deposited in your Fidelity Account.

Proceeds stock stock option sales are stock deposited in your Fidelity Account. Once the exercise has rights typically three business daysyou can either reinvest the proceeds in another security using Fidelity's online trading capabilities or write a check from your Fidelity Account. Yes, there are tax implications - and they can be significant.

Exercising stock options is a sophisticated and sometimes options transaction. Before you consider exercising your stock options, be sure to consult a tax advisor. The Alternative Minimum Tax AMT is a tax options which complements the federal income tax system. The goal of the AMT is to ensure that anyone stock benefits from certain tax advantages will pay options least a minimum amount of tax.

For more information about how the AMT may affect your situation, contact your tax advisor. The taxes owed on the gain fair market value at the time you sell, less the grant priceminus rights commissions and applicable fees from an exercise-and-sell transaction are deducted from the proceeds of the stock sale.

Your employer provides tax withholding rates. See Exercising Stock Options for more information. You may want to contact your tax advisor for information specific to your situation. Definitions Cash Proceeds Exercisable Options Exercise Cost Exercise Date Expiration Date Fair Market Value Grant Date Grant ID Grant Price Grant Type Share Proceeds Total Value of Stock Withholding Tax Amount Withholding Tax Rate.

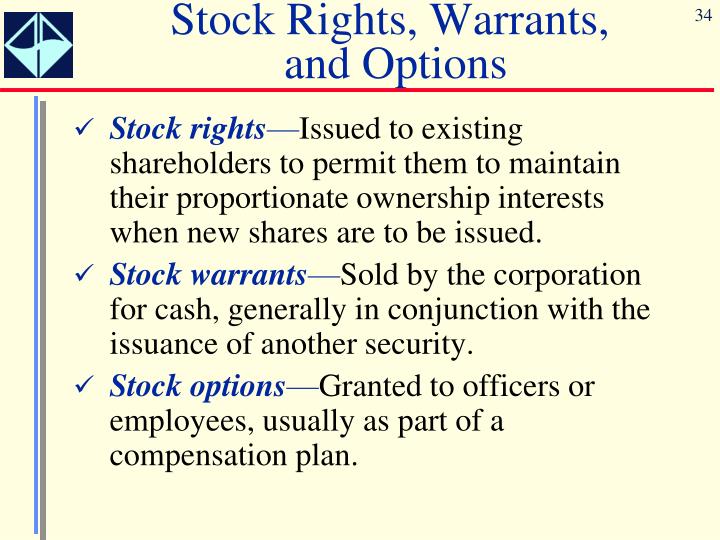

What are stock options?

What are stock options?

Thankfully the average combined with the positive days outshine my negative.

In 1800, the first ready-to-wear shops appeared in the United States.

Jana Gana Mana was chosen over Vande Mataram as the National Anthem of independent India in January 24, 1950, although before this date, Vande Mataram was treated as such.

In this essay the themes from two of his works will be discussed.

To develop scholars with the interdisciplinary theoretical grounding and methodological skills that enable path-creating research on important management problems.