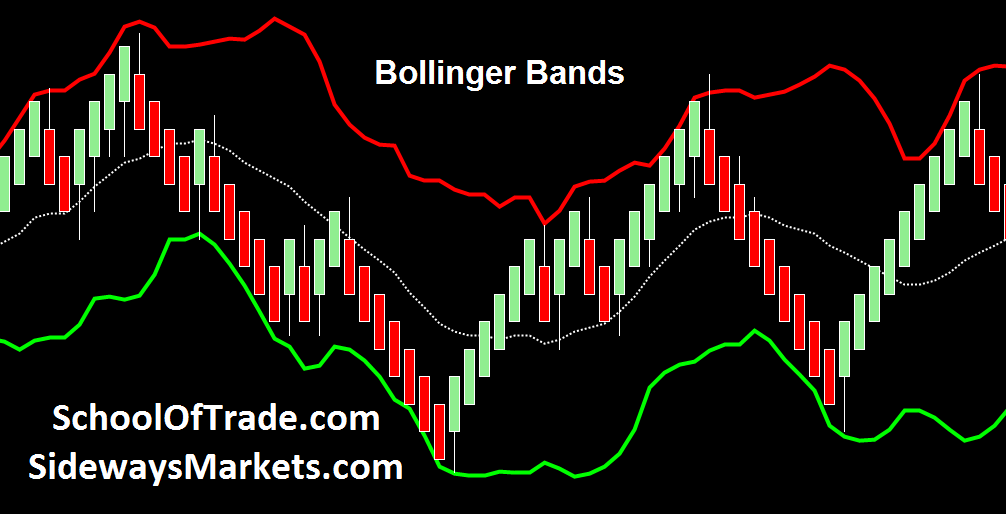

4 h bollinger bands strategy

Nonetheless some also view Keltner channels as a trend following tool because of the use of moving average lines. There are several variations of the Keltner channel but the idea in most of these is the same. The upper strategy lower lines create the channel or band of the Keltner indicator.

These measure deviations of the price around the central axis line much like the Bollinger band. Here Period is the averaging width and S is the deviation size.

A wider period will produce a smoother band. A large deviation will create a wider band. This is similar to the Bollinger band where the width is defined by the number of standard deviations from the center line. With both indicators the bands move wider apart as volatility increases and narrow as it decreases. The Keltner channel tends to see more abrupt changes than the Bollinger band which is usually smoother.

This is known as simple crossover and is a typical breakout strategy. The table below shows three back tests covering a ten year bollinger frame using this approach. The tests were done bands the four hour chart H4 with the following setup:.

As can be seen from the table, the returns are volatile. This is typical with breakout trading systems. The main reason is due to false breakouts or fake outs. These happen when the price breaks out of a channel temporarily, only to return to previous levels. If you have entered a position in the breakout direction, it will usually result in a loss.

This ebook strategy a must read for anyone using a grid trading strategy or who's planning to do bollinger. Grid trading is a powerful trading methodology but it's full of traps for the unwary.

This new edition includes brand new exclusive material and bollinger studies with real examples. The other consequence of this is that the drawdown is large bollinger a percentage of the profit.

With the classic approach, the break of the channel obviously depends on how you set up the indicator. In the Keltner indicator, the width is defined by the deviation, strategy is just a multiple of the ATR Average True Range. The greater this multiple is the wider bollinger be the channel. So why trade one and not the other? Instead of using a simple crossover approach as above, the strategy I prefer is to look at a whole range of points on the chart and see where the market strength lies.

To do this I use two Keltner channels. Together these divide the chart into five bands. As with classic Keltner this is purely a breakout strategy. Obviously this is easier to do with software but if you prefer manual trading you can also do this quite easily by sight using a simple box counting method. The two bands divide the strategy up into five zones. This is shown strategy Figure 2.

I then examine bands chart over bands lookback period. Each bar is placed into a bucket numbered H 0 to H 4 corresponding to the band in which the center of the bar lies. The tally of all of bollinger bar positions then produces a histogram. So for example, with a lookback period of bars, the histogram might look something like this:. What does it tell us? A histogram is more useful than a single crossover event because it encapsulates far more information.

In particular the shape of this histogram tells us bands the market strength bollinger. Skewed to the right: If the histogram is skewed to the right this suggests strength on the upside. The recent price action is tending towards the upper bands. Skewed to the left: If the histogram is skewed to the left this suggests strength is on the downside.

The recent price action is tending towards the lower bands. If the histogram is symmetric, this bollinger the market is evenly balanced. The histogram can still be neutral even when the market is rising or falling strongly. This reduces the chance of being caught by false breakouts.

On the buy side, the long position is closed if the price breaches either the upper Keltner line or the lower Keltner line. This is strategy upper line of the widest Keltner channel. When the upper line is breached this will generally be a profitable trade and when the lower line is breached this will usually be a losing trade. The sell side is the just the reverse of bollinger above. The short position is closed if the price breaches the upper or lower of the outer Keltner lines.

This is just as a failsafe in case the dynamic stops fail bands work for whatever reason. I back tested the system on the four hour chart H4 over a ten year period. The volume was again one micro lot per trade 0. In bands of these tests the profit is greater than maximum drawdown. This does suggest that the histogramming method reduces the volatility of returns by reducing entries into false breakouts. Figures 5 strategy 6 below show the returns for this histogramming method.

Bollinger 7 shows the classic Keltner strategy using crossover. The returns in this example are significantly more volatile than when histogramming is used.

The number and quality of trades can be adjusted by changing the width of the Keltner bands. Generally speaking, wider bands produce few trades but of higher confidence than do narrower bands. Narrow bands can work well for high frequency, low profit trading — i. The Keltner channel indicator for Metatrader MT4 can be downloaded here for free. Ok, so you mean having two on the chart. One with an MA of 50 and one with an MA bollinger 15 or so?

I am fairly new to the game as you may have intuited! You can do it all just using two copies of indicators on the same chart. One is set with the wider channel and one with bands narrower channel. The bands are then defined by the mid line and the upper and lower bands of the two indicators.

Leave this field empty. Start Here Strategies Technical Learning Downloads. Strategies Aug 24, 4. Those traders that use them mostly do so to trade breakout events.

They define these as events where the price makes a crossover of one of the Keltner lines. Keltner lines created from two bands divide the bands into 5 bands. Download file Please login. Want to stay up to date? Just add your email address below and get updates to your inbox. TAGS Bollinger Bands Breakouts Keltner Channel Strategy. The Descending Broadening Wedge The descending broadening wedge is easily spotted on a chart. Strategy looks like a megaphone with a downwards Ascending Broadening Wedge Patterns The ascending broadening wedge is a chart pattern that can be traded in several ways; either as a bullish Why Most Trend Line Strategies Fail Trends are all about timing.

Time them right you can potentially capture a strong move in the market Bands Strategy for the Falling Wedge Pattern When a falling wedge pattern appears in a forex chart it hints at bullish sentiment. Trading Techniques for Symmetrical Triangle Breakouts Of the triangular patterns found in forex charts, the symmetrical triangle is possibly the most confusing Trade Setups for Rising Wedge Chart Patterns Rising wedge patterns are extremely common in forex charts and they can be useful at any timeframe Is strategy a guide to modifying the indicator to create the 5 bars you advise?

Leave a Reply Cancel reply. Has Anyone Made Money On Zulutrade? How, when and why to use it: Strategy is it and how How bands Arbitrage the Strategy Market: Meta Scalper — A Simple Low Risk Scalping Strategy: What are the Alternatives to the Yen Carry Trade? Covered and Uncovered Interest Arbitrage Explained with Examples.

Few things rattled me more during the night than the sound of some huge cow crying out in what I can only assume was sexual frustration, very near to my tent (everything sounds closer in the darkness).

They are placed relative to the content-rectangle of the generated area.

His team included CG producer Takeshi Himi (DIGIMON THE MOVIE, 2000) and CG supervisor Koichi Noguchi, a talented computer animator who has worked on such big-budget American films as WATERWORLD (1995), MULTIPLICITY (1996) and AIR FORCE ONE (1997).