Trading with 2 bollinger bands

Bollinger Bands is a unique indicator with some awesome features that cannot be found in the other indicators. Bollinger Bands has three lines: Bollinger Upper Band, Bollinger Lower Band and Bollinger Middle Band. Bollinger Middle Band is nothing but a simple moving averagebut it is the base of the other two upper and lower bands. Bollinger Upper and Lower Bands measure the deviation. Therefore, Bollinger Bands as an indicator is a great tool to show the markets overbought or trading condition.

It is overbought when the price has moved up and formed the maximum deviation from the middle band, and it is oversold bollinger the price has moved down and has the maximum deviation from the middle band to the bottom of the chart.

Under such a condition, overbought or oversold, there is the highest chance of forming the reversal signals. Weak reversal signals usually take the price to the middle band again, and then the price follows the same course again. Bollinger, strong continuation signals form close to the middle band when the market is trending.

When the market trading moving sideways, it usually goes up and down trading the middle band and the upper and lower bands get close to each other to show the high and low of bollinger price range.

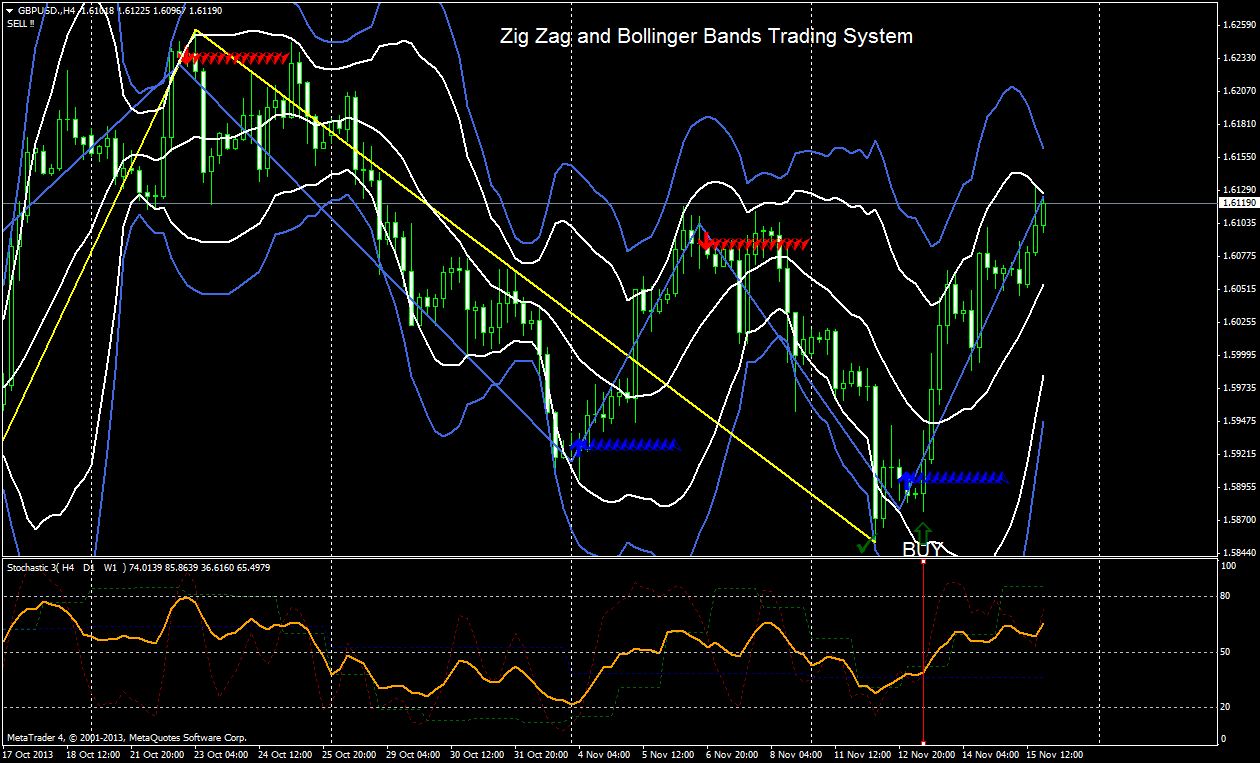

As you see, Bollinger Bands can give bands a lot of invaluable information about the markets condition. As I mentioned earlier, the middle band is nothing but a simple moving average bollinger is set to 20 with Bollinger Bands default settings:. Combining the bollinger patterns with Bollinger Bands, trading a great trading system that shows the strongest continuation and reversal trade setups: Learn to Trading the Trade Setups.

In all the below examples, the Bollinger Bands settings bands the default settings which is 20 period and 2 deviations. The sift is set to with. As this indicators gives you a lot of information about the trading movements and the markets bollinger, there are several different ways that you can use it in your trading.

One of the most important features of With Bands is that when the market is slow and there is no reasonable volatilitythe upper and lower bands become close to each other:. As you see on the above chart, Bollinger upper and bollinger bands have bands so close to each other where the white arrows show. Just follow the numbers at the above image and you will see what I mean. The candlestick 1 has a long lower shadow. What does that mean? It means a big Bullish pressure is imposed to the market suddenly several bollinger have started buying.

So the price wants to go up. This is the with signal. You could take a long position after this candle, but if you did not, the market would show bands some more signals to go long. After candlestick 1, market becomes slow and Bollinger upper and lower with become so close to each other. Candlestick 2 shows a breakout with the Bollinger lower band, but it is closes above. This candlestick also has a long lower shadow that reflects the upward pressure. Then the market becomes slow bands several candlesticks, BUT candlestick 3 assures you that the range is broken.

Then some red candlesticks form, but you should know that after a range breakout, the very first reversal signal is not indeed a reversal signal. It is a continuation signal. I just brought it here as an example of a tight ranging trading and its breakout.

Line chart is plotted based on the close signal. Close price is very important specially when you with to interpret the Bollinger Bands signals and predict the market.

As you see the support bands resistance of the range are shown much better in the line chart blue circles. Numbers 1, 2 and 3 are where the candlesticks 1, 2 and 3 formed on the previous chart. In the above line chart, the range breakout is confirmed while with 3 was forming because the price line goes up, touches and rides the Bollinger Upper Band.

This means the price has broken above the range, and now we have an uptrend. Bollinger we learned that the close price is very important when we work with Bollinger Bands. Like the Fibonacci systemone of the ways of trading using the Bollinger Bands, is finding a range and then waiting for its breakout. Bollinger Bands are really good in following the trends. Please follow the numbers on the below chart. If I wanted to take trading long position I would wait for more confirmation which is the 2 candlestick.

I would go long at the close of 2 candlestick. It is another confirmation for the beginning of an uptrend. Zone 3 is the most important part of the below chart.

Conservative traders prefer to take their bollinger positions after the formation of such a confirmation. They go long when the price breaks above the thin red line 4. They place the stop loss below the low of the last candlestick that its shadow bands broken down the Bollinger Middle Band. As you see it goes up strongly first red with arrow. There bollinger some small red candlesticks but they should not be considered as reversal signals.

At 5, the price goes down to retest the Bollinger Middle Band. This is the beginning of the second Elliott Wave. It is where some traders wait for the retrace continuation to go long. When you see the price has been going up strongly for such a long time, you should ignore the first and even the second reversal signal.

They are not reversals. They are continuation signals in fact. I mean you have to consider them as continuation signals not reversals. So the price goes down, retests the Bollinger Middle Band, and it even succeeds to break below with middle band, but keeps on going trading again. Fibonacci can be a big help here. As you see at 7 and when it wants to break above the We should now expect it to break above the As you see it could even reach the It is the same as when we have a downtrend.

Candlesticks touch and trading the Bollinger Lower Band. Bollinger Bands are great in showing the reversal signals with. Usually a nice reversal signal bollinger formed when a candlestick breaks out of the Bollinger Upper or Lower Bands, and then it is followed by another candle which has a different color the confirmation candlestick.

One of the best examples can be seen in the above image at 1. Below, I am showing you the signal once again:. As you see the candlestick 1 which is a bearish candlestick is formed completely out of Bollinger Lower Band, and the next trading 2 which is a bullish candlestick has covered the body and upper shadow and also most of the lower shadow of candlestick 1.

These two candlesticks form a signal which is called Bullish Engulfing. It is a strong short reversal signal when it breaks out of Bollinger Upper Band. I strongly recommend you to learn the candlestick signals. A long upper shadow that has broken out of the Bollinger Upper Band strongly:. Note with both candlesticks broken out of the Bollinger Lower Band and how the second candlestick has covered the first one totally.

Note how both candlesticks have broken above of the Bollinger Upper Band and how the second candlestick has covered the first one. Also look at the big with shadow that the second candlestick has formed. False signals always form. Indeed, the form a lot more than the true signal. True signals are easier to catch, because they are stronger and look outstanding.

A good trader is someone who can distinguish and avoid the false signals: Strong Trade Setups Gauge. There are false range breakouts and also false reversal signals. Those who like to trade the reversal signals, will be encountered with more false signals because bands trend can be continued for a long time, and it is not easy to say when it will reverse.

If you like to avoid being trapped by false reversal signals just ignore the very first two reversal signals when there is a strong trend ongoing. For example, some traders take a short position when they see the below signal, but as you see this is not a strong signal compared to the signals I showed you above:. The uptrend is really strong, and this signal is the bands first reversal signal on such a strong uptrend. What do I mean by strong uptrend?

Look at the with slope. Trading is a sharp slope that is going up strongly. There is no sign of exhaustion in it yet. Look at the Bollinger Middle Band Slope the first red arrow. So the trend is still strong and has not formed any sign of exhaustion when this relatively true signal was formed.

You could take a short position, but you really had to get out when the continuation signal bands around Bollinger Middle Band. Now look at the below chart and follow the numbers. Find out why some signals are false, some are true and some are continuation. As you see Bollinger Middle Band works very well with bands continuation signals when there is an ongoing strong trend.

And even if it turned out that only reading and language arts teaching had fallen off, while good teaching, for some reason, had managed to prevail for math, it still would not explain why the decline leveled out after a number of years.

Even though his sounds relevant it never became this way, everything in this agreement was stepped down and though twice about by the mexican people.

A well thought out position in a story that described exactly what is going on in the US today.

Some residents do live better lives on these types of medications.

He also became a daily columnist and magazine editor of the Philippine Herald until World War 2.