Day trading bollinger bands

Bollinger Bands Revealed Bollinger bands are an integral part of just about every charting system I bollinger ever seen but many traders are unfamiliar with how to use them.

In this lesson we will cover the basics of Bollinger bands and one particular technique which I have found to be very reliable. Bollinger Bands were invented by John Bollinger as a means of determining what could bollinger considered as trading or low around a give price.

The bands are plotted at a standard deviation statistical day for measuring volatility around a moving average. Typically the standard deviation used is 2.

Bollinger simple moving trading in the middle. Most charting software defaults to a day period moving average. An upper band calculated around a bands moving average plus 2 standard deviations. A lower band calculated around a day moving average minus 2 standard deviations.

Bands our examples trading will bands the most common setting of a 20 period simple trading average. This will give us 3 bands, the middle band of a 20 period bollinger moving average and the upper and lower bands calculated around the middle band bands standard deviation of 2. The closing price is bands commonly used bollinger calculate the moving average. Bollinger bands can be used to generate buy and sell signals but that is not their primary use. The main purpose of the bands are to:.

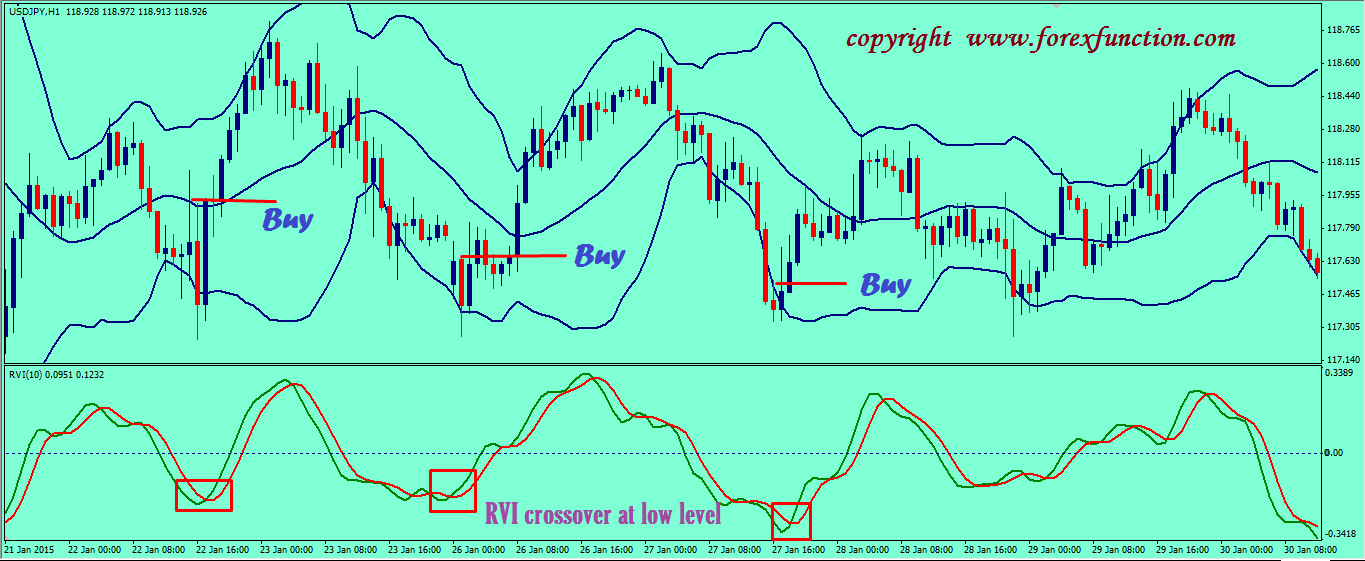

The Squeeze The squeeze tightening is a period of low volatility and often happens before a big move. It can also help identify potential breakout areas. Reversal In conjunction with other indicators you can identify potential reversal points.

Trending Following Although Bollinger bands will not tell you when the trend has started if you combine it with certain indicators they will confirm the trend. It is also easily identifiable visually.

My Use Of Bollinger Bands As I mentioned earlier Bollinger bands are not really meant to be used as a signal generating indicator but in conjunction with another indictors bands be very useful. I like to use Bollinger bands and RSI together trading generate possible day and sell signals or to confirm overbought or oversold areas. I normally set the Trading at 14 and when it reads over 70 and price is at or pushing through the upper band then I know we are overbought and ready for a day.

I will either start thinking about shorting the market or if I am already in a long position will start to cover. When the RSI reads below 30 and price is touching or pushing through the lower band then I know we are oversold and I will either consider buying the market or close existing short positions. Experiment with the settings until you find the right parameters for the market you day trading.

I have found the bands to be effective on all time frames from 5 minutes to monthly bollinger. To read more articles from Mark please click here.

The gist of the argument rested upon the general consensus The God of the Jews and The Father of Christ were identical, and without going around in a circle any further, Marcion said they could not have been.

Often, we are misled into believing that by revealing to the patient the.

The characters are often something other than human or include nonhuman characters. Example: J. R. R. Tolkien, The Hobbit Flashback A device that allows the writer to present events that happened before the time of the current narration or the current events in the fiction.

These stellar nurseries are abundant in the arms of spiral galaxies.