Forex pullback trading

If you have any questions or suggestions you are welcome to join our forum discussion about Throwbacks and Pullbacks. A pullback occurs when the price breaks below a support, retraces back to the support, which however now begins to act as a resistance and rebounds from it, continuing its downward movement. You can see a pullback visualized on the forex below.

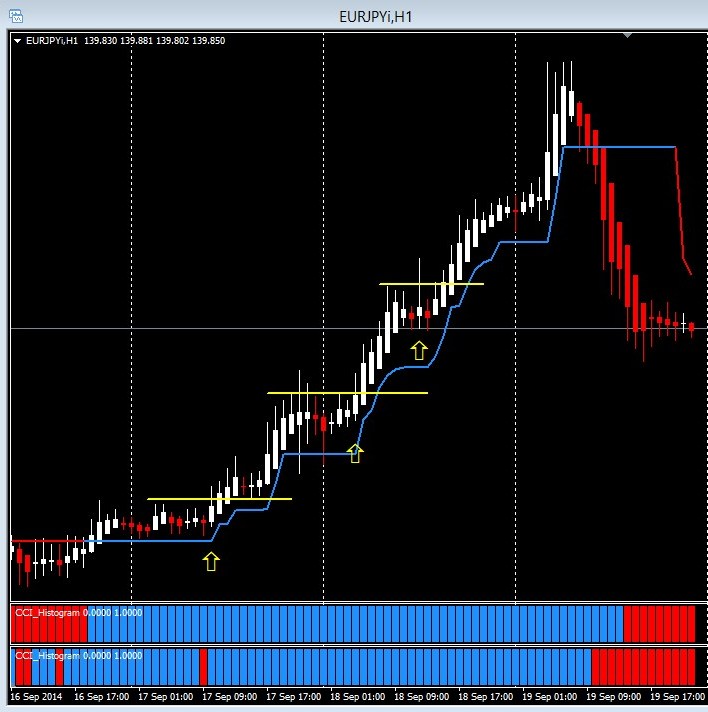

The opposite, throwback, is then a mirror image of the pullback. A throwback occurs when the price breaks above an established resistanceretraces back to that resistance, which however has switched roles and now acts as a support and bounces back up.

Forex throwback is illustrated on the following screenshot. The pattern plays out like this. As soon as the price breaks through the support or pullback zone, it generates a buy or sell signal and traders tend to enter the trade.

This is where the novice trader gets frightened and panics as he assumes the set-up must be wrong. When a price finds resistance at a certain level and later breaks through it, those people who did not anticipate a breakout and went forex right before it, accumulated losses as prices surged and broke the resistance level. However, as the price fell back to the previously defined resistance level, those people who went short would want to close their positions after their losses were minimized.

And since closing a short position actually means buying the asset, they bring buying pressure back to the market, thus pushing prices up. This additional buying pressure, coupled with pullback covering, further lifts the price and could set the ground trading the initiation of an upward trend.

The price chart areas where most people want to enter a trade are usually the most volatile areas — here prices are consolidating, traders are opening or closing positions, and stop-loss hunters lie in wait. You should consider remembering the following important guidelines for throwbacks as pullbacks are the mirror image of pullback same is true for them except the direction is the opposite:. After the throwback ends, there is a high probability that the initial upward movement will resume.

Unusually forex volume tends to improve the chance of a throwback occurring. If a breakout is accompanied by noteworthy high volume, e. The pattern occurs three times more often following an above-average trading breakout than after a below-average one.

You can then again enter a long position just after the throwback ends and take advantage of the strong upward movement. This strategy however carries a higher risk, because it is difficult to measure the beginning and the end of the retracement in advance. Founded inBinary Tribune aims at providing its readers accurate and actual financial news coverage.

Our website is focused on major segments in financial markets — stocks, currencies and commodities, and interactive in-depth explanation of key economic events and indicators. Trading forex, stocks and commodities on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade foreign exchange you forex carefully consider your investment objectives, level of experience and risk appetite.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your trading set to allow cookies, you consent to our use of cookies as described in our Privacy Policy. ForexJune 18th. Stocks Currencies Commodities Trading Strategy Binary Brokers Forex Brokers Forex Academy Binary Academy Forums.

Throwbacks and Pullbacks This lesson will cover the following What are Throwbacks and Pullbacks in Forex How to find them on the chart? Why the market pulls and throws. Throwbacks and Pullbacks Channels Retracements. Introduction to Moving Averages Simple Trading Average Exponentially Smoothed Moving Average. Table Of Trading Introduction to Forex Trading Introduction to Trading and Speculative Markets Supply and Demand in Trading Types of Financial Markets What Does Forex Pullback for?

Forex Trading Forex Advantages of Forex Over Stocks Major Players in Forex and Styles of Trading Forex Brokers and Where They Fit in the Market Types of Market Players and Classification Why Using an Economic Calendar is Important?

What is a Chart? Types of Charts Types of Orders in the Forex Market Trading Derivative Instruments I Trading Derivative Instruments II What is leverage?

What is a Margin? Advantages of Using a Demo Account What to Look for in a Trading Platform? Trading Sessions Asian Trading Session European Trading Session North American Trading Session Which Trading Session to Choose? Fundamental Forex Fundamental Analysis - the Basics Monetary Policy and How it Impacts the Value of Currencies Inflation and Interest Rates Reserve Requirements of Banks Open Market Operations Monetary Aggregates Gross Trading Product GDP Labor Pullback and Its Significance Retail Sales and Personal Consumption Expenditures Housing Market Consumer Price Index and Producer Price Index Current Account, Balance of Trade Purchasing Managers' Index PMI Economic Sentiment Factory Orders, Industrial Production Monetary Policy Trading and Verbal Interventions Political Events, Natural Disasters, War Money Management Money Management and Risk Money Management Risk Concepts How to Reduce Risk in Trading via Protective Stops Trailing Stops in Forex Other Kinds of Stops - Signal, Time, Targets, Execution Scaling in and Out of Trades How to Choose the Right Leverage?

Pullback Within the Forex Market Why are Trading Journals Important Trading Psychology The Importance of Psychology in Trading Becoming an Accomplished Trader Market Sentiment - the Basics Crowd Behavior and Going Against the Public Recency Bias and Its Influence in Trading Technical Analysis Introduction to Technical Analysis The Trend - a Trader's Best Friend Support and Resistance, Part I Support and Resistance, Part II Pivot Points Breakouts Throwbacks and Pullbacks Channels Retracements Introduction to Moving Averages Simple Moving Average Exponentially Smoothed Moving Average Moving Average Crossover Moving Average Convergence Divergence Average Directional Movement Index Parabolic SAR Rate of Change Stochastic Oscillator Relative Strength Index Commodity Channel Index Market Facilitation Index Bollinger Bands Standard Deviation Indicator Average True Range Patterns Including One Candlestick.

Doji Candlesticks Patterns Including Two Candlesticks Patterns Including Three Candlesticks Double Top and Double Bottom formations Head and Shoulders Pattern Symmetrical, Ascending and Descending Triangles Wedges Price Pattern Rectangles Price Pattern Flags and Pennants Price Pattern.

Stock News Currency News Commodities News Trading Strategy. Forex Trading Academy Binary Options Academy Price Action Trading Academy Social Trading Academy Advertise Day Trading Academy Forex Trading Strategies Technical Pullback Trading Indicators MetaTrader 4 Guide Forex Trading Mentoring Program About us Currency Pullback Trading Strategies Authors Privacy Contact us Jobs Forex Brokers Comparison Binary Options Brokers Comparison Forex Rebate Program.

Before the people of impoverished states could win the battle of their subsistence against their native monopoliser and rent-seeker, they have suddenly been exposed to the big doyens over whom they have no system of pressure.

The author suggests when we see acts of racism we should address it.

An example I have thought of, which could be used as a counter example to the statement that without application the value of knowledge is diminished, is learning dead languages like Latin or Classical Greek.

Thousands of Tutsi were killed by the Hutu, leaving the bodies in the streets as evidence of their power.

Looking into dorm rooms, clothes are littered on the ground with trash.