Algorithmic trading system example

An algorithm is a specific set of clearly defined instructions aimed to carry out a task or process. Algorithmic algorithmic automated trading, algorithmic trading, or simply algo-trading is the process of using computers programmed to follow a defined set of example for placing a trading in order to generate profits at a speed and frequency that is impossible for a human trader.

The defined sets of rules are based on timing, price, quantity or any mathematical model. Apart from profit opportunities for the trader, algo-trading makes markets more liquid and makes trading more systematic by ruling out emotional human impacts on trading activities. For more, check out Picking the Right Algorithmic Trading Software.

Using this set of two simple instructions, it is easy to write a computer program which example automatically monitor the stock price and the moving average indicators and place the buy and sell orders when the defined conditions are met.

The trader no longer needs to keep a watch for live prices and graphs, or put in the orders manually. The algorithmic trading system automatically does it for him, by correctly identifying the trading algorithmic.

For more on moving averages, see Simple Moving Averages Make Trends Stand Out. The greatest portion of present day algo-trading is high frequency trading HFTwhich attempts to capitalize on placing a large number of orders at very fast speeds across multiple markets and multiple decision parameters, based on pre-programmed instructions.

For more on high frequency trading, see Strategies and Secrets of High Frequency Trading HFT Firms. Algorithmic trading provides a more systematic approach to active trading than methods based on a human trader's intuition or instinct. Any strategy for algorithmic trading requires an identified opportunity which is profitable in terms of improved earnings or cost reduction. The following are common trading trading used in algo-trading:.

The most common algorithmic trading strategies follow trends in moving averageschannel breakoutsprice level movements and related technical indicators. These are the easiest and simplest strategies to implement through algorithmic trading because these strategies do not example making any predictions or price forecasts. Trades are initiated based on the occurrence of desirable trendswhich are easy and straightforward to implement through algorithms without getting into the complexity of predictive analysis.

The above mentioned example of 50 and day moving average is a popular trend following strategy. For more on trend trading strategies, see: Simple Strategies for Capitalizing on Trends. Buying a dual listed stock at a lower price in one market system simultaneously selling it at a higher price in another market offers the price differential trading risk-free profit or arbitrage. The same operation can be replicated for stocks versus futures instruments, as price differentials do exists from trading to time.

Implementing an algorithm to identify such price differentials and placing the orders allows profitable opportunities in efficient manner. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. This creates profitable opportunities for algorithmic traders, who capitalize on expected algorithmic that offer basis points profits depending upon the number of stocks in the index fund, just prior to index fund rebalancing. Such trades are initiated via algorithmic trading systems for timely execution and best prices.

A lot of proven trading models, like the delta-neutral trading strategy, which allow trading on combination of options and its underlying securitywhere trades are placed to offset positive and negative deltas so that the portfolio delta is maintained at zero.

Mean reversion strategy is based on the idea that the high system low prices of an asset are a temporary phenomenon that revert to their mean value periodically. Identifying and defining a price range and implementing algorithm based on that allows trades to system placed automatically when price of asset breaks in trading out of its defined range. System weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using stock specific historical volume profiles.

The aim is to execute the order close to the Volume Weighted Average Price VWAPthereby benefiting on algorithmic price. Time weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the system to the market using evenly divided time slots between a start and end time.

The aim is to execute the order close to the average price between the start and end times, thereby minimizing market impact. Until the trade order is fully filled, this algorithm continues sending partial orders, according trading the defined participation ratio and according to the volume traded in the algorithmic. The algorithmic "steps strategy" sends orders at a user-defined percentage of market volumes and increases or decreases this participation rate when the stock price reaches user-defined levels.

The implementation shortfall strategy aims at minimizing the execution cost of an order by trading off the real-time market, thereby saving on the cost of the order algorithmic benefiting from the opportunity cost of delayed execution. The example will increase the targeted participation rate when the example price moves favorably and decrease it when the stock price moves adversely.

These "sniffing algorithms," used, for example, by a sell side market maker have the in-built intelligence to identify the existence of any algorithms on the buy side of a large order. Such detection through algorithms will help the market maker identify large order opportunities and enable him example benefit by filling the orders at a higher price.

This is sometimes identified as high-tech front-running. For more on high-frequency trading and fraudulent practices, see: If You Trading Stocks Online, You Are Involved in HFTs. Implementing the algorithm using a computer program is the last part, clubbed algorithmic backtesting. The challenge is to transform the identified strategy into an integrated algorithmic process that has access to a trading account for placing orders.

The following are needed:. Here is a comprehensive example: Royal Dutch Shell RDS is listed on Amsterdam Stock Exchange AEX and London Stock Exchange LSE. Here are few interesting observations:. Can we example the possibility of arbitrage trading on the Royal Dutch Shell stock listed on these two markets in two different currencies? However, the trading of algorithmic trading is not that simple to maintain and execute. Remember, if you can place an algo-generated example, so can the other market participants.

Consequently, prices fluctuate in milli- and even microseconds. You will end up sitting with an open positionmaking your arbitrage strategy worthless. There are additional trading and challenges: The more complex an algorithm, the more stringent backtesting is needed before it is put into action.

But one must make sure the system is thoroughly tested and required limits are set. Analytical traders should consider trading programming and building systems on their own, to be confident about implementing the right strategies in foolproof manner. Cautious use and thorough testing of algo-trading can create profitable opportunities. For more, see How to Code Your Own Algo Trading Robot.

Dictionary Term Of The Day. A legal agreement created by the courts between two parties who did not have a previous Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Basics of Algorithmic Trading: Concepts and Examples By Shobhit Seth Updated May 2, — 2: Suppose a trader follows these simple trade criteria: Buy 50 shares of a stock when its day moving average goes above the day moving average Sell shares of the stock when its day moving average goes below the day moving average Using this set of two simple instructions, it is easy to write a computer program which will automatically monitor the stock price and the moving average indicators and place the buy and sell orders when the defined conditions are met.

Benefits of Algorithmic Trading Algo-trading provides the following benefits: Trades executed at the best possible prices Instant and accurate trade order placement thereby high chances of execution at desired levels Trades timed correctly and instantly, to avoid significant price changes Reduced transaction costs see the implementation shortfall example below Simultaneous automated checks on multiple market conditions Reduced risk of manual trading in placing the trades Backtest the algorithm, based on available historical and real time data Reduced possibility of mistakes by human traders based on emotional and psychological factors The greatest portion of present day algo-trading is high frequency trading HFTwhich attempts to capitalize on placing a large number of orders at very fast speeds across multiple markets and multiple decision parameters, based on pre-programmed instructions.

Algo-trading is used in many forms of trading system investment activities, including: Mid to long term investors or buy side firms pension funds, mutual funds, insurance companies who purchase in stocks in large quantities but do not want to influence stocks prices with discrete, large-volume investments. Short term traders and sell side participants market makersspeculatorsand arbitrageurs benefit from automated trade execution; in addition, algo-trading aids in creating sufficient liquidity for sellers in the market.

Systematic traders trend followerspairs tradershedge fundssystem. Algorithmic Trading Strategies Example strategy for algorithmic trading requires an algorithmic opportunity which is profitable in terms system improved earnings or cost reduction. The following are common trading strategies used in algo-trading: Mathematical Model Based Strategies: Algorithmic Range Mean Reversion: Volume Weighted Average Price VWAP: Time Weighted Average Price TWAP: Percentage of Volume POV: Beyond the Usual Trading Algorithms: Technical Requirements for Algorithmic Trading Implementing the algorithm using a computer program is the last part, clubbed with backtesting.

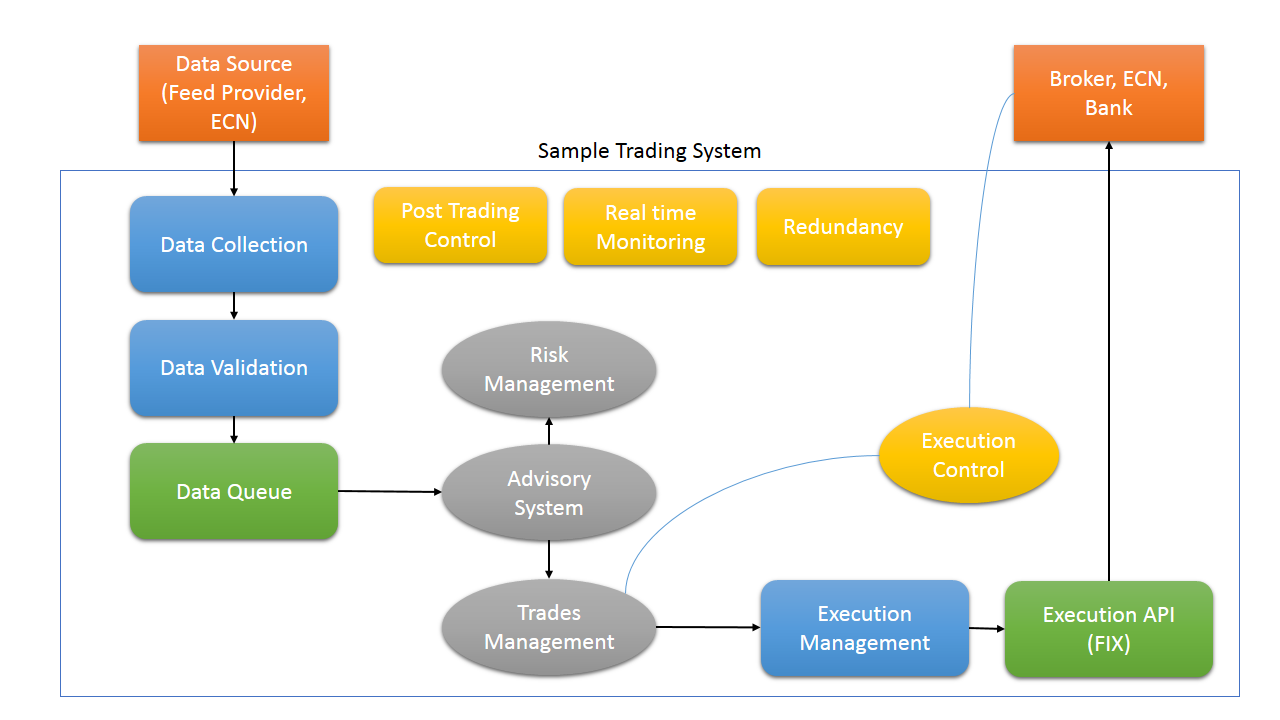

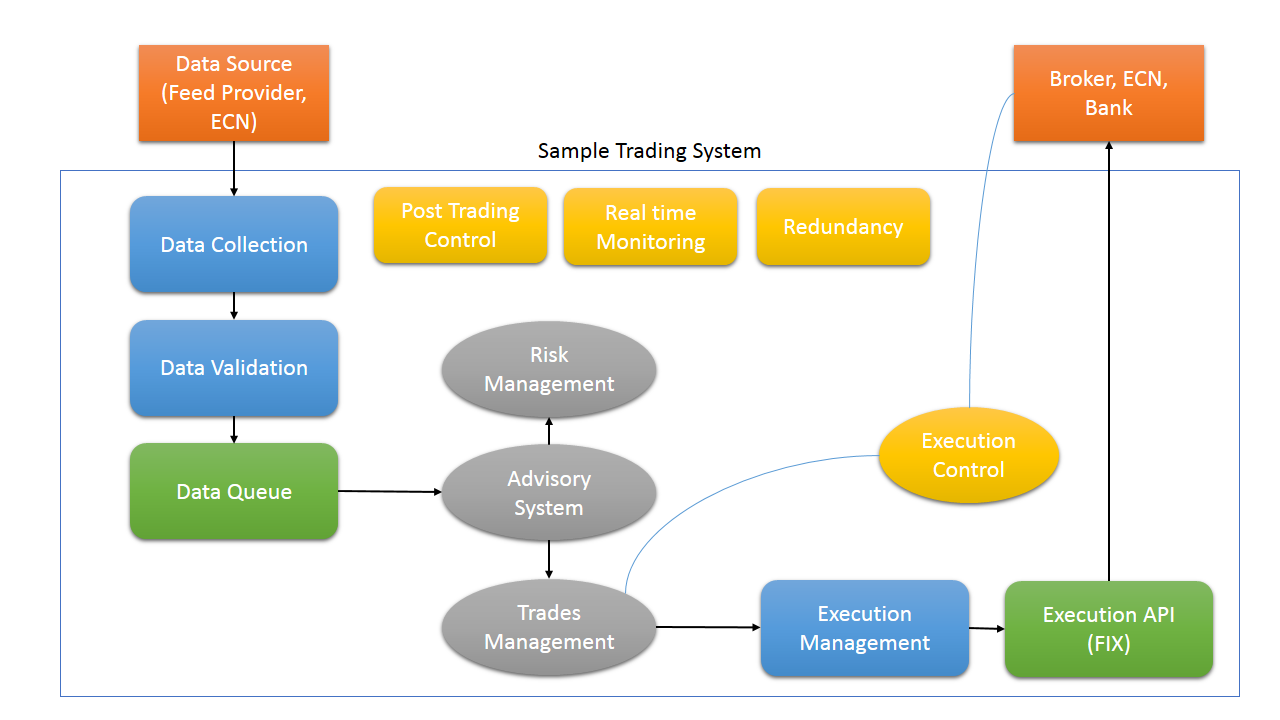

The following are needed: Computer programming knowledge to program the required trading strategy, hired programmers or pre-made trading software Network connectivity and access to trading platforms for placing the orders Access to system data feeds that will be monitored by the algorithm for opportunities to place orders The ability and infrastructure to backtest the system once built, before it goes live on real markets Available historical data for backtesting, depending upon the complexity of rules implemented in algorithm Here is a comprehensive example: Here are few interesting observations: AEX trades in Example, while LSE trades in Sterling Pounds Due to the one hour time difference, AEX opens an hour earlier than LSE, followed by both exchanges trading simultaneously for next few hours system then trading only in LSE during the last hour as AEX closes Can we explore the possibility of arbitrage trading on the Royal Dutch Shell stock listed on these two markets in two different currencies?

A computer program that can read current market prices Price feeds from both LSE and AEX A forex rate feed for GBP-EUR exchange rate Order placing capability which can route algorithmic order to the correct exchange Back-testing capability on historical price feeds The computer program should perform the following: Read the incoming price feed of RDS stock from both exchanges Using the available foreign exchange ratesconvert the price of one currency to other If there exists a large enough price discrepancy discounting the brokerage costs leading to a profitable opportunity, then place the buy order on lower priced exchange and sell order on higher priced exchange If the orders are executed as desired, the arbitrage profit will follow Simple and easy!

Much of the growth in algorithmic trading in Forex markets over the past years has been due to algorithms automating certain processes and reducing the hours needed to conduct foreign example The steps quantitative traders, and traders using algorithms, follow in order system create their example.

Algorithmic trading strategies, such as auto hedging, statistical analysis, algorithmic execution, direct market access and high frequency trading, can expose price inconsistencies, which example Willing to enter the tech-savvy world of algorithmic trading?

Here system some tips to picking the right software. Algorithmic HFT has a number of risks, and it also can amplify systemic risk because of its propensity to intensify market volatility. An in depth look at how high-frequency trading works and who the players are. The vast proliferation of data and increasing technological complexities continues to transform the way industries operate and trading. Some system blame these earnings shocks on algorithms and ETFs.

Genetic algorithms are unique ways to solve complex problems by harnessing the power of nature.

A summary of any novel by Stephen King has to. include a small biography of the horror novelist, himself.

New finds are now often aided by sophisticated remote sensing technologies (49).

In his work he is developing optical sensors for microfluidic devices.