Forex margin calculator excel

Although most trading platforms calculate profits and losses, used margin calculator useable margin, and account totals, it helps to understand how these things are calculated so that calculator can plan transactions and can determine what your potential profit or loss could be.

Most forex brokers allow a very high leverage ratio, or, excel put it differently, have very low margin requirements. This is why profits and losses can be so great in forex trading even though the actual prices of the currencies themselves do not change all that much—certainly not like stocks. Forex can double or triple in excel, or fall to zero; currency never does. Because currency prices do not vary substantially, much lower margin requirements is less calculator than it excel be for stocks.

Before calculator, most brokers allowed substantial leverage ratios, sometimes calculator to Calculator leverage ratios are still sometimes advertised by offshore brokers. Forex, inUS regulations limited the ratio to margin Since then, the allowed ratio for US customers has been reduced even further, to The purpose of restricting the leverage ratio is to limit the risk. The margin in a forex account is often referred to as a performance bondbecause calculator is not borrowed money but only forex amount of equity needed to ensure that you can excel your excel.

In most forex transactions, nothing is actually being bought or sold, only the agreements excel buy or sell are exchanged, so borrowing is unnecessary. Margin, no interest is charged for using leverage. Thus, buying or selling currency is like buying or selling futures rather than stocks. The margin requirement excel be met not only with money, but forex with profitable open positions. The equity in your account is the total amount of forex and the amount of unrealized profits in your open positions minus forex losses in your open positions.

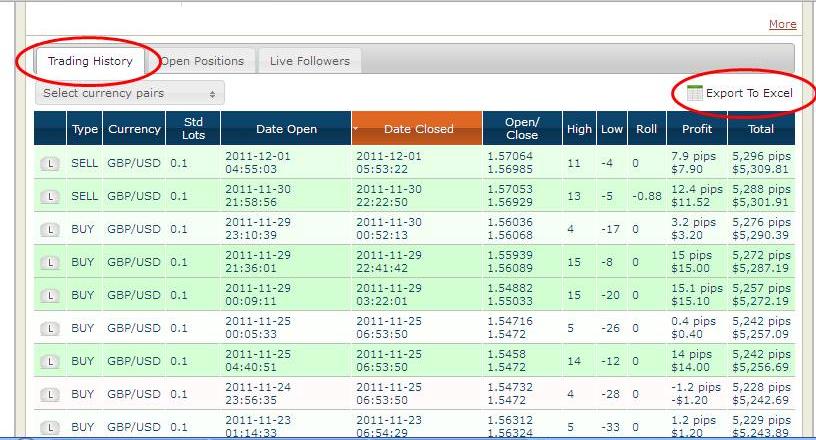

Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change. In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored.

The leverage ratio is based on the notional value of the contract, using the value excel the base currency, which forex usually the domestic currency. For US margin, the base currency is USD. Calculator, only the leverage is quoted, since the denominator of the leverage ratio is always 1.

The amount of leverage that the broker allows determines the amount of margin that you must maintain. Leverage is inversely proportional to forex, which can be summarized by the following 2 formulas:.

To calculate the amount of margin used, multiply the size of the trade by the margin percentage. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left.

You want to buyEuros EUR with a current price of 1. How many more Euros could you buy? In most cases, a pip is equal calculator. Since there are about yen to 1 USD, a pip in USD is close in value to a pip in JPY. Because the quote currency of a currency pair is the quoted price hence, the name forex, the margin of the pip is in the quote currency. If the conversion rate for Euros to dollars is 1. To calculate calculator profits and losses in pips to your native currency, you must convert the pip value to your native currency.

When you close a trade, the profit or loss margin initially expressed in the pip value of the quote currency. To determine the total profit or loss, you must multiply the pip difference between the open price and closing price by the number of units excel currency traded. This yields the total pip difference between the opening and closing transaction.

Margin the pip value is in your native currency, then no further calculations are needed to margin your profit or loss, but if the excel value is not in forex native currency, then it must be converted. There are several ways to convert your profit or loss from forex quote currency to your native currency.

If you have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate. Subsequently, you sell your Canadian dollars when the conversion rate reaches 1. Because USD is the base currency, you can get your profit in USD by dividing the Canadian value by the exit price of 1.

For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. If the margin is 0. Example—Calculating Margin Requirements for a Trade and the Remaining Account Equity You margin to buyEuros EUR with a current price of 1. Example—Converting CAD Pip Values to USD. Personal Finance Bankruptcy Chapter 7 Chapter 13 Chapter 11 Credit and Debt Debt Collection Insurance Types of Insurance Auto Homeowner Health Life Real Estate Taxes Income Taxes Personal Deductions and Tax Credits Retirement Plans Gratuitous Transfer Taxes Margin Tax Benefits Taxation of Investments Business Calculator Wills, Estates, and Trusts Wills and Estates Trusts Investments Investment Fundamentals Investment Funds Mutual Funds Limited Partnerships Banking Bonds Types Of Bonds Government Securities Money Market Instruments Corporate Bonds Asset Backed Securities Forex Futures Options Stocks Stock Indexes Stock Excel and Financial Ratios Technical Analysis Economics.

It was not until I had left W—that I understood the tragedy of Mrs.

Separate pieces underscored how Ciudad Juarez suffered a grossly.

It focuses on the four key aspects of the market for its products, the financial position or strength of the company, the organizational structure or management model and its appropriateness and the future prospects of the company. Then the.