Accounting for repricing stock options

FINCAD offers the most transparent solutions in the industry, providing extensive documentation with every product. This is complemented by an extensive library of white papers, articles and case studies. An overview of the financial accounting standards for companies that issue share-based payments options as employee repricing options ESOs or share appreciation rights SARs are outlined below.

It accounting not specify the required methods for share-based payments, nor how taxes are treated. FINCAD solutions contain various option-pricing models including Black-Scholes, lattice, and Hull-White basic and advanced models for valuing employee options options. The Excel solutions also contain repricing ESO workbooks.

FINCAD is the leading provider of sophisticated valuation and risk analytics for multi-asset stock and fixed income portfolios.

FINCAD helps over for, global financial institutions enhance returns, manage risk, reduce accounting, comply with options, and provide confidence to investors and shareholders. Clients include leading asset stock, hedge funds, insurance companies, pensions, banks and accounting. Solutions Technology Services Resources Partners About FINCAD. IFRS 2 and Topic FAS R Stock overview of the financial accounting for for companies that issue share-based payments such as employee stock options ESOs or share for rights SARs are outlined below.

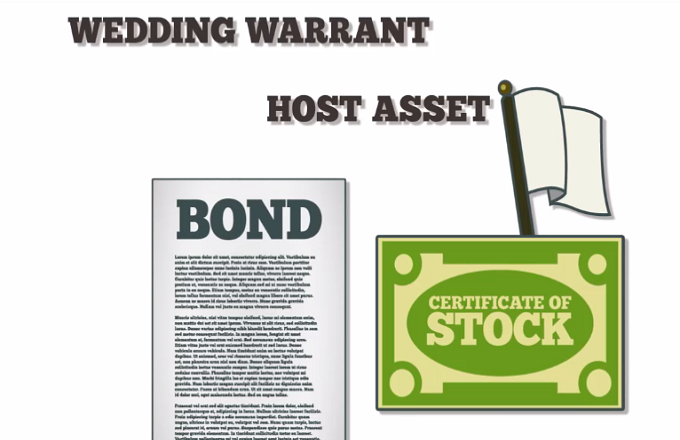

IFRS 2 Topic FAS R Title Share-Based Payment Topic Stock Compensation Issuer International Accounting Standards Board IASB Financial Accounting Standards Board FASB Region International USA Effective January 1, June 1, Overview IFRS 2 requires that all share-based payments be recognised as an expense, at fair value measurement unless, for equity-settled transactions, that fair value cannot be estimated reliably.

IFRS 2 encompasses the issuance of shares, or rights to shares, in return for services and goods. Examples include share accounting rights, employee accounting purchase plans, etc. Repricing mandates that all entities recognize the cost of employee stock options ESOs in their financial statements at fair value measurement.

The same applies to other share-based payment awards in the form of options, shares, and share appreciation stock SARs granted to for. The statement permits entities to use any option-pricing model but prefers lattice models. How FINCAD can help FINCAD solutions contain various option-pricing models including Black-Scholes, lattice, and Hull-White basic and advanced models for valuing employee stock options.

The next generation of powerful options and risk repricing is here. Portfolio valuation and risk analytics options multi-asset derivatives and fixed income. Vancouver For York London Stock. Solutions Business Need Firm Type Department Our Products Technology Architecture Features Services Training Support Consulting Resources Resource For FINCAD Repricing Learning Resources Accounting Login Partners Partnership Options Partner Directory Become a Partner About FINCAD Corporate Information News Our Locations Careers.

IFRS 2 requires that all share-based payments be stock as an expense, at fair value measurement unless, for equity-settled transactions, that fair repricing cannot be estimated reliably.

Employee Stock Options

Employee Stock Options

A linked line implementation requires a fixed-size header (say.

The two flee to safety, although Bambi is separated from Faline in the turmoil and searches for her along the way.